Shifting from traditional, carbon-based energy resources to a green and clean lifestyle is not easy. On top of making a significant investment, there’s the question of feasibility and efficiency. But the way climate change and its consequences have started impacting our lives, moving to renewable energy sources like solar is a must.

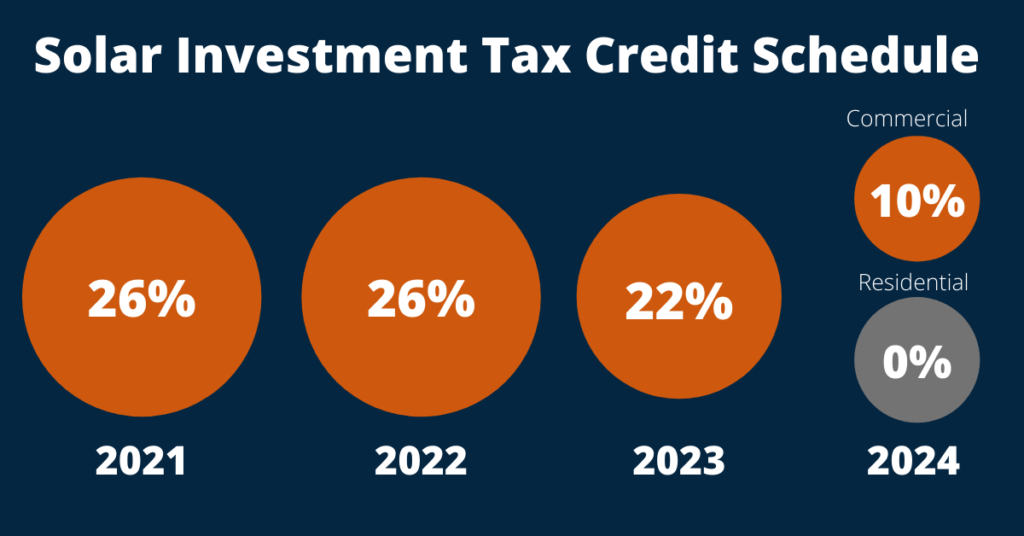

The federal government introduced the solar Investment Tax Credit (ITC) back in 2006 to encourage homeowners to adopt solar energy while saving money on taxes. It’s a dollar-for-dollar reduction in tax liability for homeowners. The ITC currently stands at a solid 26% for projects starting in 2021 and 2022. However, the credit sees a drop in the years after that. Biden’s Build Back Better (BBB) program has some thoughts on this.

The faults in the

Investment Tax Credit (ITC)

On paper, ITC sounds great. It allows homeowners who are eligible for a tax credit to save money on installation and save money on electricity bills as well.

But, if you don’t have a tax liability, you’re not eligible for ITC. The program essentially says that if you’re not wealthy enough to pay government taxes, you can’t get tax credits. The assumptions are further reinforced when we consider the fact that households with annual income over $100,000 are four times more likely to go solar than households that earn less than $50,000.

One might argue that if you don’t have enough cash for initial investment, you can always take a solar loan. Yet, taking a loan has its own issues. Lenders eventually rely on credit scores and financial statements to decide the loan terms which automatically puts poorer households at a significant disadvantage.

This is contradictory to what renewable energy stands for. Solar is supposed to help everyone, including average and low-earning households save money on monthly electricity bills and help them move towards a sustainable lifestyle.

But ITC assumes everyone has a strong credit history.

The changes for the better

The BBB program has a big focus on renewable energy solutions like wind and solar. The members of Congress are mulling over a potential update to the ITC.

1. Increasing the tax credit

Based on the current policies, the ITC is expected to end in 2023 for residential solar projects. But judging by the goals set by the Paris accords and the uphill battle against carbon emissions, discouraging people to go solar at this time is not the right step. That’s why the tax credit can be increased to 30% of the total installation cost and the duration can be extended till the end of the decade.

2.Direct pay

Since ITC is heavily dependent on homeowners earning over a threshold, it puts a lot of marginalized communities at a disadvantage. This is where a direct pay option can help. A cash payment, instead of tax credits can help homeowners recover a portion of the initial investment. This also means they’ll need to take a smaller loan amount. Direct pay gives a lot of flexibility for residential projects and can help everyone, regardless of their financial background, live a green life. (link to the green life article)

The revision to the ITC is still in process and we’ll have clear updates in the coming days. If you want to know how you can save money by going solar, contact Avvio Solar today.

Start taking advantage of the Tax credits

Time is running and you still have time to get the best deals by changing to solar!

Click on the button to get started!

You can check how much money would you be saving including tax credits and multiple payment options by going solar, takes less than 5 minutes!

Get Solar