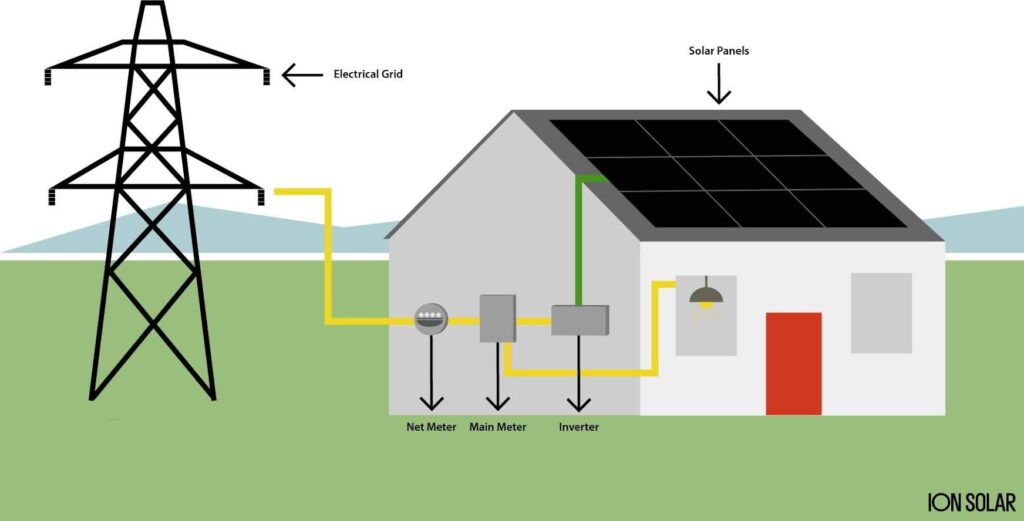

One of the strongest incentives powering the growth of residential solar is net metering. When the sun is shining in abundance, several states and utility providers pay solar homeowners for the excess electricity provided to the grid. In other words, if your solar panels generate more power than your household uses, you can send this power back to the utility company and receive credits on your next monthly utility bill. Some states even provide the option to receive a cash payout for the value of the credits.

Aside from South Dakota and Tennessee, every state has some form of net metering or alternative reciprocity. The following states even offer full retail net metering:

- Arkansas

- California

- Colorado

- Connecticut

- Delaware

- Florida

- Idaho

- Illinois

- Indiana

- Iowa

- Kansas

- Maine

- Maryland

- Massachusetts

- Minnesota

- Montana

- New Hampshire

- New Jersey

- New Mexico

- New York

- North Carolina

- Ohio

- Oregon

- Pennsylvania

- Texas

- Utah

- Vermont

- Virginia

- Washington

- West Virginia

However, there are some changes coming to net metering in 2022. We’re here to break these changes down, and what it means for you.

CHANGES IN CALIFORNIA

California was one of the first states to have a net metering program. The current policy in California is known as NEM 2.0, and has been in effect since 2016. Although there have been many pandemic-related delays, policymakers are proposing the revised NEM 3.0 to take effect within the next 6 months. There are a few key changes being proposed.

Under NEM 2.0, homeowners were credited for their excess energy at retail rate, the same amount that customers pay. It also varied based on time of day and the energy demands at that time. For instance, the middle of the day in summer months would have a higher retail price than night time in the summer. The new policy under NEM 3.0 would credit homeowners with a predetermined rate that is closer to “wholesale” price that does not vary based on demand.

Furthermore, NEM 3.0 introduces a net billing arrangement in which credits would be added to each monthly bill. This means that you can’t “bank” these credits to use throughout the year when your energy needs exceed what your solar panels provide.

Lastly, NEM 3.0 proposes to have a monthly “grid benefits charge” for solar homeowners, with the exception being low-income customers. Even if the homeowner always produces excess energy to sell, they would still have to pay this monthly fee that is projected to be around $75.

Homeowners who go solar and submit their Interconnection Application prior to June 2022 (assuming there are no more delays) can be grandfathered into NEM 2.0. If you are considering going solar in 2022, try to make it happen prior to this date to ensure you get the best monetary incentive.

CHANGES IN FLORIDA

Currently in Florida, homeowners are credited at retail rate on a 1:1 basis. All net metering agreements have a 20 year lock-in, meaning that the net metering agreement will be upheld for the next 20 years. The new policy, written by the utility companies it benefits, has a scheduled step down reciprocity starting in 2024. In 2024, solar homeowners will only get 75% of the credit. In 2026 it drops to 60%, until 2027 when it drops to the final amount of 50% credit.

However, if you already have solar panels OR you obtain an approved net metering agreement before the end of 2023, you can still have the 1:1 rate for the next 20 years. An important caveat about all this is that it only applies to public utilities. If you are part of a utility co-op or municipal utility company, exclusions apply. These types of utility companies will have their own net metering policies. Depending on your area, these companies may be incentivizing their solar customers or they may jump on board with the public utility companies. Either way, it is important to check before agreeing to a 20 year policy.

Without a doubt, if you are considering solar panels in Florida, getting them installed and having a net metering agreement in place before the end of 2023 would be your best option in the long run.

CHANGES IN NORTH CAROLINA

Currently, net metering in North Carolina is credited at a 1:1 retail rate for solar homeowners. The new policy proposed by Duke Energy, the major utility provider in the state, contains one major change: all solar homeowners will be switched to TOU (time of use) rates. They have established four categories of rates to be charged – Discount (6.09 cents per kWh), Off Peak (8.04 cents per kWh), On Peak (19.23 cents per kWh), Critical Peak (35 cents per kWh). These rates are as of February 2022 and may very well change each year.

Seeing as most excess energy is produced at off-peak times, this weakens the ratio and would not level out to a 1:1, but rather an unknown reciprocity, determined by how Duke Energy samples energy demands that are subject to change. Although all new solar customers will automatically be subject to policy, non-solar customers will have the option to switch to this billing change.

This is proposed to take effect for solar homeowners installing after January 1, 2023. If you install prior to that date, you will be able to stay on the flat rate system that is a true 1:1 net metering until December 31, 2037. An important caveat to this new policy is that solar homeowners that have installed prior to the first day of 2023, who are on the flat rate net metering system, will have added fees to their monthly bill after January 1, 2027.

Take Advantage of the Best Solar Incentives in 2022

These states have been leaders in incentivizing home solar panel installation, but change is sweeping across the industry. In the coming months and years, we are likely to see more states proposing new net metering policies. One trend is clear: deadlines matter for solar in 2022. If you install before a certain deadline, you are locking yourself in for the best long term savings. With 2022 being the last year to cash in on the full 26% solar Federal Tax Credit, now is certainly the best time to install solar for maximum savings and benefits.

Photo Credit: @JMJagtenberg